Overview

The Payroll process is used to produce employee paychecks/pay at the end of a pay period. There are a number of input variables (input data) that are used to execute the payroll. These variables, if not correct can negatively affect the outcome of the payroll (payroll process), how correct are the paychecks produced by the payroll process. The input variables to the online payroll services include employee timesheet during the pay period, leaves taken during the pay period, changes in compensations and/or deductions, and changes in tax status of the employee. As well as pay exceptions during the pay period, such as a onetime compensation or deduction. The following is the list of variables/data that are used by the payroll process:

-

Pay Period Type Change

-

Employee Timesheet

-

Employee Leaves

-

Employee Expenses

-

Compensation Changes

-

Deduction Changes

-

Organization Change

-

Job Change

-

Employee Name Change

-

Address Change

-

Tax Status Change

-

Marital Status Change

-

Onetime Compensation Exception

-

Onetime Deduction Exception

-

Payroll GL Account Change

-

Employee Pay Currency Change

-

Employee Bank and Bank Account Change

-

Employer Bank and Bank Account Change

If any of the above variables/data is incorrect, then the outcome of the payroll process will be incorrect. In order to ensure an accurate payroll, the above variables must be correct for all employees. Now imagine that the above variables (input data) need to be managed for 1,000 or more employees, and for multiple pay periods, the task of running the payroll becomes very complex and error prone.

Yes, using an automated payroll system will make processing the payroll easier, however it still does not ensure that the payroll input variables/data will be correct as the definition of these variables involves manual tasks. And conducting manual tasks can result in data gathering and recording errors. Having said that, in order to improve the payroll process, we need to improve the definition, gathering, and recording of payroll variables – Payroll Input Data.

In this blog, I shall discuss how we can reduce the errors in payroll input data through planning and establishing effective payroll policies and controls. By reducing the number of errors in the payroll input data/variables, we will drastically improve the payroll process/outcome. It should be understood that the quality of the payroll outcome is directly linked to the quality of the payroll input data. If there is large number of errors in the payroll input data, this will negatively impact the quality of the payroll process/outcome. Thus, we need to focus on how to reduce the number of errors in the payroll input data.

Understanding Payroll Variables/Input Data

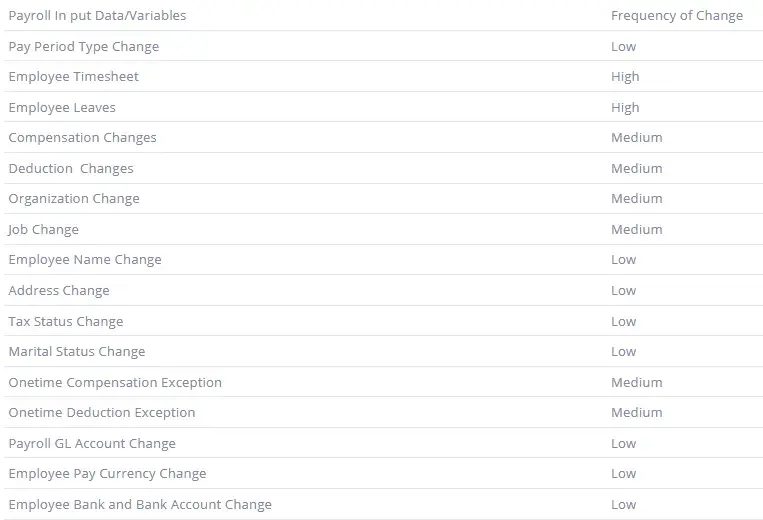

Payroll Variables/Input Data can be categorized into two categories based on the frequency of change, (1) Frequent Change, and (2) Less Frequent Change. Input data that changes frequently are the timesheet and leave data. While employee baseline data such as employee address, baseline compensations, etc., that affect the payroll changes less frequently. The table below shows the frequency level of change for each type of payroll Input data.

Categorizing the payroll input data by frequency of change will give us an understanding of the nature of the payroll input data. While timesheet and leave data tend to change every pay period, employee baseline data that affects the payroll tend to change seldom. In order to minimize the errors in the payroll input data, we need to minimize the frequency of changes to the payroll input data. This can be achieved by using a planned and controlled change.

In short there are two types of payroll input data:

- Employee Baseline Data – This is the employee personnel record which includes employee demographic data, address, organization unit and job, and compensation data which includes earnings, allowances, benefits, bonuses, and commission, standard recurring deductions, and taxes. This type of data seldom changes and it changes due to an HR action. This type of data is non-pay period (NPP) based.

- Timesheet, Leave, and Exception Data – This data changes from pay period to pay period. Employees supply their timesheet at the end of each pay period to derive absent time, overtime, and labor distribution as well as leave taken during the pay period. Exception data is used to calculate a one time compensation or deduction during the pay period. This type of data is pay period (PP) based.

We can reduce the frequency of changes of NPP data, while we cannot control the frequency of PP data. Reason is that PP data has to occur every pay period (e.g., Monthly, Semi-Monthly, Biweekly, or Weekly).

Understanding Payroll Input Data Errors

We have discussed the two types of payroll input data including NPP based data and PP based data. Errors can occur in both types of data. However, most of the errors occur in PP based data as changes in PP data tend to occur more frequently than NPP data changes. And the types of errors that occur have to do with data collection/gathering, data recording, and data entry. The types of errors are the result of two variables: (1) Volume (V) of Data being collected or changed, and (2) Frequency (F) of Collection and processing of Data. So the error rate in the Payroll Input Data increases with the volume of the data that needs to be collected and the frequency by which this data is collected and/or changed. So error rate can be stated as follows:

err = function (V,F

We cannot control the volume of the data to be collected or changed, but we can control the frequency of data collection and specifically the frequency of data change. Example, in the case of PP Data, if we have 1000 employees, then we need to collect 1000 Timesheets at the end of each pay period. The data volume in this case is 1000 Timesheets, and the frequency is 1 collection time per pay period. If the pay period is weekly, then we need to collect 1,000 Timesheets per week, which means four to five times per month depending on the month. In this case the frequency of data collect (1,000 Timesheets) is 4 to 5 times per month.)

By converting the 1,000 employees from weekly pay period to monthly pay period, we will decrease the frequency of data collection from 4 to 1 time per month. Thus, drastically reducing the error rate of the payroll input data. Let’s say that the error rate in reporting and entering 1000 Timesheets is 2%, so each time we collect and enter 1,000 timesheets, we will end up with 20 errors per week, or 80 errors per month. However, If the employees are on a monthly pay period, we will have only 20 errors, so we have reduced the total number of errors by 75%. To stay on the conservative side, let’s assume the cost of correcting each error is $50, leading to a total cost of $4,000 to correct 80 errors if employees are on the weekly pay period, however, if employees are on the monthly pay period, then the total cost of correcting the errors is $1,000. Thus, a saving of $3,000 per month or $36,000 per year.

Similarly, the same reasoning can be applied to leave data which impacts the payroll. By establishing sound policies, we can reduce the volume and frequency of leave requests per pay period. Instead of allowing the employee to apply for leave anytime, we can institute a leave policy that reduces the volume and frequency of leave requests, where leave requests are scheduled for specific periods in the year. Example employees can only apply for leave on certain months of the year and the leave (vacation/annual leave) cannot be broken down. By doing so, the volume and frequency of leave requests will be reduced, thus reducing the volume of Payroll input data, and reducing the payroll input data errors.

Similar approach can be used when dealing with NPP data. Note again that the objective is to reduce the volume and frequency of Payroll Input Data, thus reducing the Data Error Rate. In the case of NPP data, we can establish sound policies to limit the number and frequency of HR Actions that affect the payroll. Example, instead of having an ad hoc HR Action process in place, we can establish a systemic HR Action process, where employees can only be hired on the 1st of each month, and any change to employee compensations and benefits can only be effective on the 1st of the month. By implementing these simple policy changes, we reduce the payroll input data volume and frequency, and thus reducing the number of Input Data Error, which improves the payroll process.

Planning and Controlling Payroll Input Data

As stated, Payroll Input Data (PID) is the primary cause of most of the problems associated with processing the payroll. If the payroll input data is of poor quality, large number of errors, then the outcome of the payroll process will not be correct. The following frames the relationship between the quality of the payroll process outcome, and the quality of the payroll input data:

Quality(Payroll Outcome) = Function of Quality(Payroll Input Data)

Quality(PO) = F( Number of Errors in Payroll Input Data and Type of Errors)

Quality(PO) = F( Errors(PID),ErrorType(PID)

Therefore, in order to improve the payroll process, we need to improve the quality of payroll input data. Meaning, we need to reduce the number of errors in the payroll input data. Reducing the number of errors in the payroll input data can be achieved through planned and controlled change to the data as shown in figure-1. Planned and controlled change to the payroll input data can be achieved by implementing simple policies that impact the volume and frequency of the payroll input data. Some of the policies that can be implemented and which will have a drastic positive impact on the quality of the input data, and thus improving the outcome of the payroll process:

- Reduce the frequency of change to employee baseline data by implementing a scheduled change to employee baseline data outside the payroll run cycle.

- Reduce the number of HR Actions that affect the payroll by implementing a scheduled HR Actions outside the payroll run cycle.

- Use monthly pay period for all employees to reduce the number of timesheets that need to be produced and processed, and reduce the number of payroll runs. If not possible to have all employees on monthly pay period, use semi-monthly pay period.

- Use one single pay period type (Monthly, Semi-Monthly, Biweekly, or Weekly) for all employees. Do not use multiple pay period types.

- Eliminate or Reduce use of Off Cycle Payroll

- Eliminate or Reduce use of Retroactive Payroll

- Establish policies to have planned and controlled data change

- Use time and attendance devices (e.g., Biometric Clocks) to gather and process data when dealing with large volume of data such as the Timesheets. This will eliminate data errors due to manual gathering and recording of data.

Conclusion

The root cause of most of the problems associated with the Payroll Process is the quality of the Payroll Input Data. There is a direct correlation between the Payroll Input Data Quality and Payroll Outcome quality. Therefore, to improve the Payroll Process, we need improve the quality of the Payroll Input Data. To improve the quality of the Payroll Input Data, we need to reduce the volume and frequency of data gathering, recording, and data entry. To achieve this, we can implement simple policies that reduce the volume and frequency of input data changes and implement planned and controlled change of the Payroll Input Data. By doing so, and using effective Integrated Time & Attendance, Leave Management, and Payroll System such as Interact HRMS, you will achieve a drastic improvement your organization payroll process, leading to timely and correct payroll process outcome and large cost savings.

If you need best online payroll services or QuickBooks Payroll support and how we can help your organization, please give us a call at 888-865-5255 or send us an email at accounts@rayvat.com