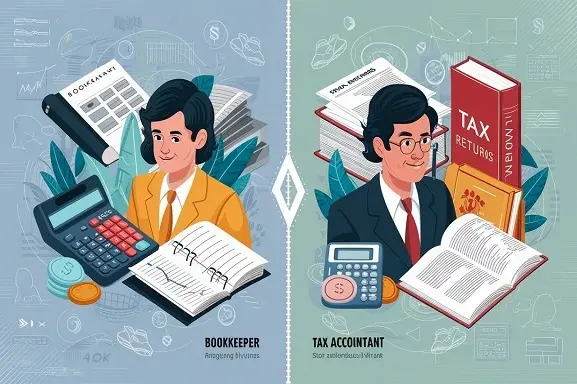

Bookkeeping Functions: The Difference Between a Bookkeeper and Tax Accountant?

Several small business people remain unaware of the difference between the services of a bookkeeper and a tax accountant. Although there are some similarities in the work that they perform, they mainly relate to the core operations of a business. Whereas each has its unique features and strengths, understanding these differences can assist you in determining whether you require one, the other, or both for your business.

In essence, a bookkeeper is tasked with keeping and recording accounts.

A bookkeeper is responsible for keeping a record of the transactions that a business organization undertakes daily. Their primary responsibilities include:

- Recording transactions - A bookkeeper writes down the financial transactions that occur in recordkeeping software. This ranges from income, expenditures, payroll, deposits, invoices, payments to vendors, and the like; works to make sure that it goes into the right accounts.

- Balancing of books – A bookkeeper regularly endeavors to match the company’s records of financial transactions with the records of a bank statement and credit card statement.

- Furnishing income statements – From the recorded information, a bookkeeper can compile income statements that depict the firm’s revenues, costs, and expenses. These are offered to business owners alongside the reconciliation reports.

- Payroll processing – While companies need to pay employees for their work and overtime, bookkeepers are capable of managing payroll. This entails tax and other payroll forms of liability for payment.

More specifically, the duties of bookkeepers include entering transactions, preparing financial statements from time to time, calculating remunerations and wages, and comparing and reconciling accounts.

A tax accountant is a professional who focuses on taxes and is involved in various activities linked to taxes in one’s career.

A bookkeeper is involved in daily transactions and charges while a tax accountant mainly attends to tax-related and compliance with tax services. Their key duties include:

- Tax planning and consulting – It is the practice through which tax accountants assist their clients on the best approach to reduce their tax rates responsibly. This can be decisions that affect the form of business, the form of accounting, or the form of a material business transaction.

- Tax management – The tax accountant is responsible for the preparation of periodical tax statements and filings from the financial records. This entails tax returns of the business as well as tax returns for the employees such as the staff payroll tax.

- Internet support- a tax accountant responds to a tax audit or inquiry on behalf of the business. They address questions and can also seek documents in the course of the process.

- Data processing and consultancy – tax accountants can go through the client’s financial documents and advise them on how to manage their taxes and their overall financial position.

Simply put, tax accountants are involved in planning, preparing, filing, auditing, and analyzing taxes as a subject rather than typical cost accounting.

Key Differences Summarized

To recap, here are the main differences between what bookkeepers and tax accountants do:To recap, here are the main differences between what bookkeepers and tax accountants do:

Bookkeepers:

- Handle basic data entry of all activities performed financially.

- Reconcile accounts

- Develop the financial statements that should be used in the interim period

- Process payroll

- This factor requires that taxpayers do not pay their taxes directly to the tax authorities.

Tax Accountants:

- Concentrate your practice on tax services including planning, returns, and review.

- Suggest measures that can help in lowering tax liability

- If you are self-employed or have other sources of income apart from your job, then you need to file your taxes.

- Appear for clients if it is audited

- Depend on the work of bookkeepers to maintain clear and correct records

Consumer Guide on Making the Best Decision for Product Acquisition

The large majority of small companies require sound accounting functions in bookkeeping along with tax accounting proficiency. It is possible to hire professional and qualified staff or contractors to conduct both roles affirmatively and ensure that the organization’s finances are tracked accurately or to optimize the full potential of the available tax rules and regulations.

As the business expands, there will be a need to employ a permanent bookkeeper while outsourcing the work of preparing the accounts for taxation purposes. Or vice versa as per your requirement or your pocket allows you to afford.

However, it is recommended that whether following one of the approaches, you should always establish the responsibilities. This makes it possible for the bookkeeper and the accountant to share information to ensure that all data needed for tax planning is captured accurately.

Contact us here for Accounting services now!