A Wall Street Journal survey indicates that over 50% of successful businesses have engaged a CFO on a full or part-time basis. The aim is to streamline their financial records to avoid penalties and also have a clearer view of the financial position of the business. To get the best services before gaining the desired capacity, startups are outsourcing accounting firm.

Proper recording and maintenance of your financial records will keep your business operations in order. You can detect loss and profit instances to take the right steps. But what are these bookkeeping services that appear to be so crucial for startups?

What is Bookkeeping?

The basic definition of bookkeeping is the recording of financial transactions of a company daily. The aim is to track all finances coming into the businesses or leaving in the form of expenses. The resulting information helps you to make financing, operational, and investment decisions.

Accuracy in bookkeeping is essential for financial institutions, investors, and regulators because it will give a picture of your financial health. Internally, bookkeeping helps you to make decisions that are backed by data. The information will also give you an accurate measure of your performance daily. Tips we list below can help you get a handle on bookkeeping basics that will help your startups business succeed.

- Understand Business Accounts

- Basic Types Of Accounts

- Set Up Your Business Accounts

- Record Every Financial Transaction

- Prepare Financial Statements

- Small-Business Bookkeeping Important

Understand Business Accounts

The accounting needs of a business will depend on such factors as the industry you are operating, the type of money you are handling, resources available to support your accounting, and your accounting knowledge, among other factors. The basis of online accounting services for any business is to understand the elements that a business will have to interact with daily.

-

Customers– they buy the goods and services you provide. They are your sources of revenue or finances.

-

Employees– they provide services to your business. They are an expense through salaries and facilitation.

-

Vendors and suppliers– they supply or sell the items you need to run your business. They have to be paid for these services. They may supply goods like computers, furniture, food, etc, or such services like auditing, legal advice, and transport, among others.

-

Debt Sources of capital– these are finances coming from debt or investment by shareholders. They have to be repaid within the stipulated time.

-

Equity source of capital– the individuals and equity firms that provide capital to your business. They will be expecting dividends or profits.

-

Government– it collects taxes and duties from your operations.

The accounts and statements you prepare for your business will enable you to have an accurate feel of your financial position and operations. You can tell whether the business is making losses or profits, and items that are taking up most of the expenditure. You will also justify the investment or cost-cutting decisions you make about your business. Since accounting is done daily, you will not be surprised by poor performance. Business accounting gives you a better understanding of your profits and losses to avoid eating into your capital while you think that you are making profits.

Basic Types Of Accounts

Each business has to keep records of different elements of its operations including cash transactions, banked funds, assets, expenses, and liabilities, among others. Separation of accounts helps an entrepreneur to understand different elements of operations. For instance, bank reconciliation will be easier if you keep records of banked cash and unbanked revenues. Here are the types of accounts that each start-up should keep.

-

Cash account– it captures your payments, cash deposits, and cash withdrawals. It will help you to capture petty cash and small purchases made.

-

Bank accounts– it records all transactions made to the bank. It must include checks, wired monies, and cash deposits, among others. You can reconcile that using a monthly statement from the bank.

-

Income accounts– it captures all the monies coming into the business. It strengthens your accounts receivable books and can help you to identify mistakes.

-

Assets– the account helps you to keep track of all assets owned by the business. It should capture assets from equity and for investment purposes.

-

Liabilities– it helps you to record future payments and debts that the business owns.

There are many other accounts including accounts payable, equity account, and forex exchange profit and losses accounts, among others. The type of account you set up will depend on your nature of operations and the type of resources required.

Set Up Your Business Accounts

Manual accounting is no longer tenable because it denies you the opportunity to analyze data or access it remotely. Online accounting allows you to enter data through the phone or from a remote location, and also access the information any time you wish. There are excellent applications including Quickbooks, Xero, Wave, and others, to help you capture your accounting data.

The choice of application will depend on the features it offers and how well they suit your business needs. Quickbooks, for example, will help you to start small and graduate slowly as the business grows. It has a dashboard and allows you to include add-ons to enhance your experience.

Xero is a perfect choice for small businesses that reinforce their activities through integration. It would fit your payroll processing needs because you can link and share information with multiple partners. Wave, on the other hand, fits basic accounting needs for any business. It does not require advanced knowledge and will, therefore, help you to keep your accounts in order at the lowest price.

Read More: Top 10 Reasons To Use QuickBooks

Record Every Financial Transaction

Accurate business records help you to run a profitable business. Any missing entry will cause your books to fail to balance. This is why experts insist on recording every financial transaction made in cash or any other mode. The records must also capture the service charges because they are deducted from the account. The use of convenient apps like Quickbooks Bookkeeping makes it convenient to make entries at the point of purchase or disbursement of funds. You avoid reliance on memory because it might fail you during recording.

Prepare Financial Statements

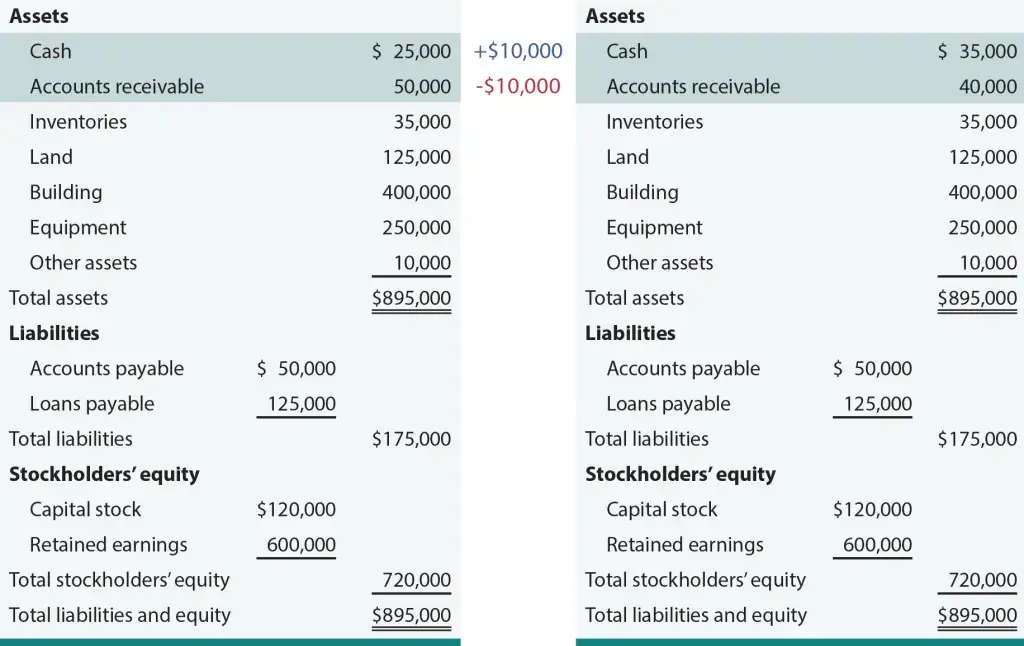

Financial statements are bound by time. You can prepare the statements each day, week, month, year, or whichever period is convenient for your accounting purposes. Technology has allowed you to enter the details manually or download statements and synch them with your records. Details on different statements can be used to countercheck the accuracy of your statement. For instance, a balance sheet will tell you about the financial health of your business. An addition of cash accounts and bank accounts will give you the correct liquidity position.

Small-Business Bookkeeping Important

Bookkeeping is crucial for small businesses so that they can start at the correct footing. It will be a huge mistake to say that you are not a ‘math person’. It takes a few minutes to monitor your daily expenditure and income to keep track of performance. You will avoid eating into your capital or viewing all your revenue as profit. You can also monitor losses as early as they begin to eat into your finances.

Last Word

Entrepreneurs and start-ups cannot ignore the place of bookkeeping in the establishment of successful enterprises. The records should be kept from day one and their accuracy maintained. Use available online and offline tools to keep track of your finances and generate comprehensive reports that aid in prudent business decision making.

Kindly contact us for more details and a specific quote.